All Categories

Featured

Table of Contents

Rate of interest will certainly be paid from the date of fatality to day of repayment. If fatality results from natural reasons, death profits will be the return of costs, and rate of interest on the premium paid will go to a yearly effective rate defined in the policy contract. Disclosures This policy does not assure that its earnings will be enough to spend for any kind of certain service or product at the time of requirement or that services or goods will be provided by any kind of specific provider.

A complete statement of coverage is found just in the plan. For more details on protection, expenses, constraints; or to apply for insurance coverage, speak to a local State Ranch agent. There are limitations and problems pertaining to payment of advantages as a result of misrepresentations on the application. funeral cover up to 85 years. Rewards are a return of costs and are based upon the actual mortality, expenditure, and investment experience of the Business.

Permanent life insurance develops money value that can be obtained. Policy finances accumulate passion and overdue plan lendings and interest will reduce the survivor benefit and money worth of the policy. The amount of cash worth readily available will generally rely on the kind of long-term policy acquired, the quantity of insurance coverage purchased, the length of time the plan has actually been in pressure and any kind of outstanding plan car loans.

Our point of views are our very own. Interment insurance policy is a life insurance plan that covers end-of-life expenses.

Funeral insurance coverage requires no medical examination, making it available to those with clinical conditions. The loss of a loved one is psychological and stressful. Making funeral prep work and finding a method to spend for them while regreting includes an additional layer of anxiety. This is where having funeral insurance coverage, also called final cost insurance policy, can be found in handy.

Nonetheless, streamlined issue life insurance policy calls for a health analysis. If your health and wellness status disqualifies you from typical life insurance, interment insurance coverage might be an alternative. In enhancement to less health exam requirements, funeral insurance has a quick turn-around time for authorizations. You can obtain protection within days or perhaps the very same day you use.

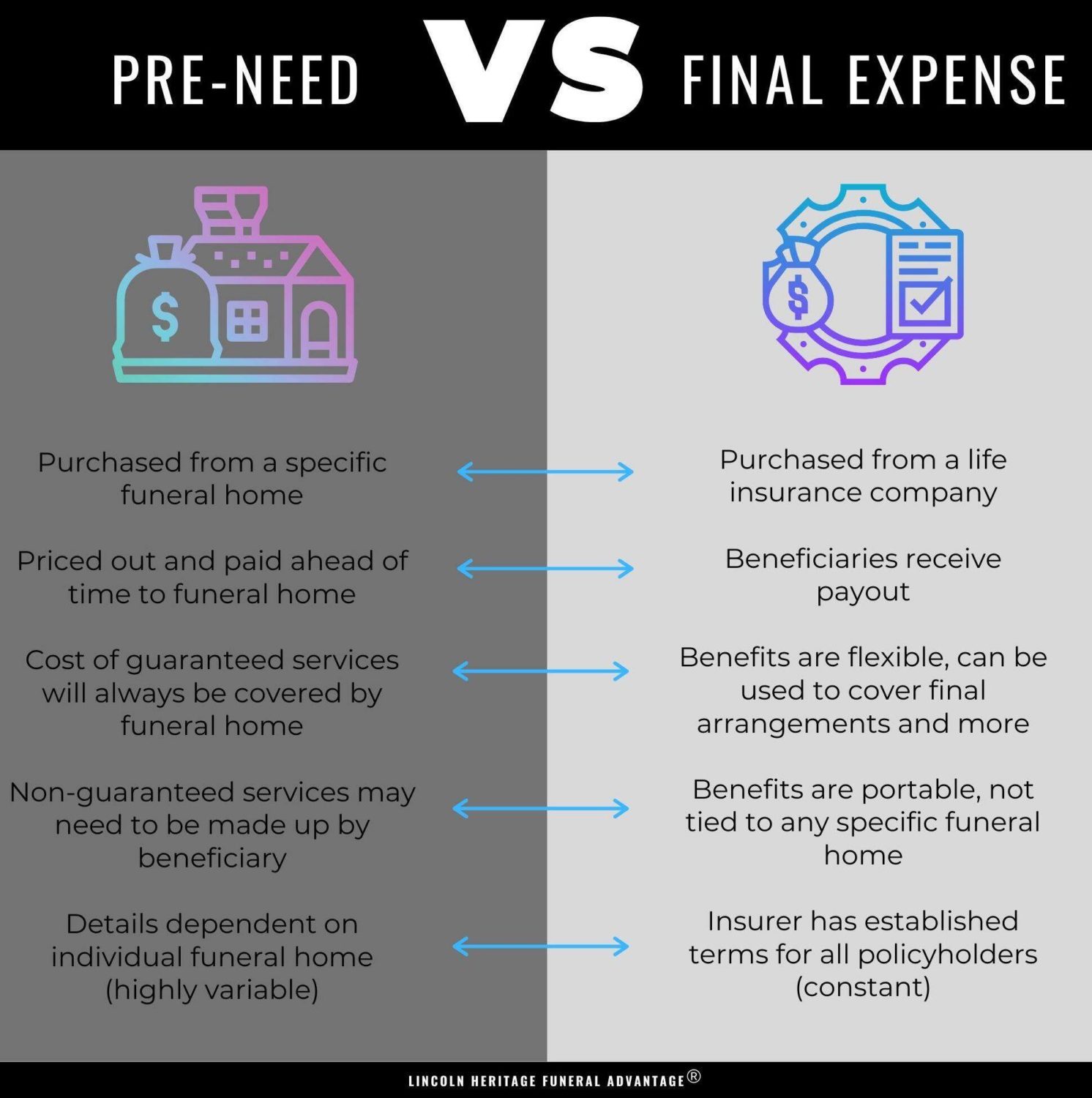

Pre Need Plans Vs Life Insurance

, burial insurance coverage comes in several types. This plan is best for those with light to moderate health problems, like high blood pressure, diabetes mellitus, or bronchial asthma. If you don't want a medical examination however can qualify for a streamlined issue plan, it is generally a better offer than an assured issue plan since you can obtain even more coverage for a cheaper premium.

Pre-need insurance policy is high-risk due to the fact that the beneficiary is the funeral home and insurance coverage specifies to the picked funeral home. Ought to the funeral chapel go out of service or you vacate state, you might not have coverage, and that defeats the purpose of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Partnership (FCA) recommends versus buying pre-need.

Those are basically interment insurance coverage. For assured life insurance coverage, premium computations rely on your age, gender, where you live, and insurance coverage amount. Understand that insurance coverage quantities are limited and vary by insurance company. We found example quotes for a 51-year-woman for $25,000 in protection living in Illinois: You might determine to choose out of interment insurance coverage if you can or have saved up adequate funds to pay off your funeral and any kind of arrearage.

Affordable Burial Insurance For Seniors

Burial insurance coverage uses a simplified application for end-of-life coverage. Most insurance companies need you to speak to an insurance policy agent to use for a plan and get a quote.

The objective of having life insurance is to reduce the problem on your loved ones after your loss. If you have an extra funeral policy, your liked ones can make use of the funeral plan to deal with last expenditures and get an instant dispensation from your life insurance to handle the home mortgage and education and learning prices.

Individuals that are middle-aged or older with clinical conditions may consider funeral insurance, as they may not get approved for typical policies with stricter authorization standards. Additionally, burial insurance coverage can be valuable to those without comprehensive savings or conventional life insurance policy coverage. real insurance funeral cover. Burial insurance differs from other kinds of insurance policy because it provides a reduced survivor benefit, usually only adequate to cover costs for a funeral and other linked expenses

News & World Record. ExperienceAlani is a previous insurance other on the Personal Financing Expert group. She's reviewed life insurance policy and animal insurance coverage firms and has actually composed numerous explainers on travel insurance coverage, credit history, financial debt, and home insurance. She is enthusiastic concerning demystifying the complexities of insurance and various other personal money topics to ensure that viewers have the information they need to make the very best money decisions.

Funeral Cover Prices

Final expenditure life insurance coverage has a number of advantages. Final expenditure insurance coverage is typically suggested for seniors that might not qualify for conventional life insurance policy due to their age.

Furthermore, last expense insurance coverage is useful for individuals that wish to spend for their very own funeral. Funeral and cremation services can be expensive, so final expenditure insurance offers comfort knowing that your liked ones won't need to use their financial savings to pay for your end-of-life arrangements. Nonetheless, final expense protection is not the most effective product for every person.

You can take a look at Principles' overview to insurance policy at different ages (life insurance after 85) if you require aid determining what sort of life insurance policy is best for your stage in life. Obtaining entire life insurance policy via Values is fast and easy. Protection is readily available for elders in between the ages of 66-85, and there's no medical examination required.

Based upon your responses, you'll see your estimated price and the amount of coverage you qualify for (in between $1,000-$ 30,000). You can acquire a plan online, and your protection begins immediately after paying the initial costs. Your rate never transforms, and you are covered for your entire lifetime, if you continue making the regular monthly payments.

Burial Insurance No Medical Exam

Final cost insurance coverage provides benefits yet calls for careful consideration to figure out if it's right for you. Life insurance policy for last expenses is a type of irreversible life insurance created to cover prices that occur at the end of life.

According to the National Funeral Service Supervisors Association, the ordinary price of a funeral service with funeral and a watching is $7,848.1 Your loved ones might not have access to that much cash after your fatality, which might include in the stress and anxiety they experience. Furthermore, they may come across various other costs related to your passing away.

It's typically not costly and fairly simple to obtain (florida burial insurance). Final cost insurance coverage is sometimes called burial insurance policy, yet the cash can spend for virtually anything your liked ones require. Recipients can utilize the fatality advantage for anything they require, allowing them to deal with the most important economic priorities. In most cases, enjoyed ones spend cash on the adhering to things:: Pay for the funeral or cremation, seeing, place rental, officiant, flowers, catering and more.

: Work with specialists to help with managing the estate and navigating the probate process.: Close out represent any type of end-of-life treatment or care.: Settle any type of other debts, consisting of auto finances and credit report cards.: Beneficiaries have full discretion to utilize the funds for anything they need. The money might even be made use of to develop a tradition for education costs or contributed to charity.

Latest Posts

Funeral Plans Comparison

Whole Life Burial Insurance For Seniors

Funeral Plans Comparison